Why we focus on retirement at every stage of your life

Since retirement is so important, it requires lifelong planning and preparation. It also can raise questions. Have I saved enough? Will I have the income I need? Can I avoid outliving my money?

If you’re a young wealth builder, we’ll point you in the right direction, explain the different types of tax-advantaged retirement accounts and help you track your progress.

If you’re preparing to retire, we’ll help you determine a retirement date and the best time to claim Social Security benefits.

If you’re already retired, we’ll help you address the three major risks that could derail your retirement plan.

Your retirement could last 30 years or more and may be the largest expense you’ll ever face. Consider that people are living longer, and you won’t be receiving a regular paycheck.

A mistake many retirees make is continuing to invest as they always have.

There are three phases of a lifetime of investing: wealth accumulation, wealth preservation and wealth distribution. How should each phase be invested and why?

We have a process that answers these questions and can help solve these problems.

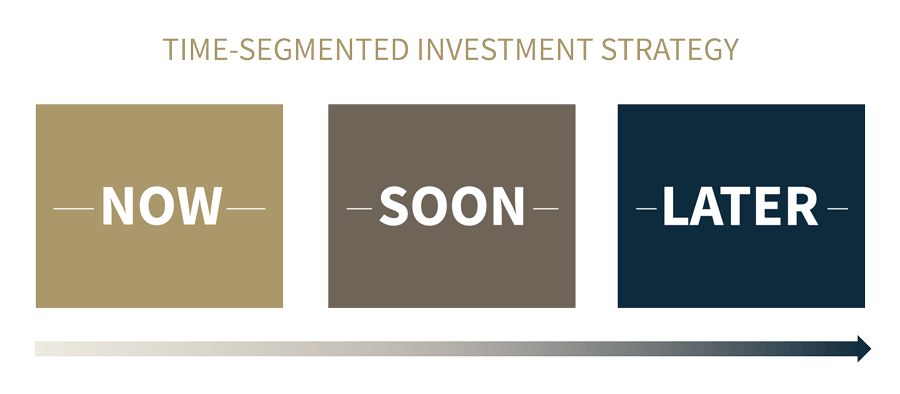

Our strategy divides your retirement nest egg into segments (or buckets), each with a different purpose and time horizon. The length of these segments varies, and each is customized to your cash flow needs. The process is designed to address the three major risks that can derail your retirement plan.

TIMING RISK: Beginning your retirement during a down market

INFLATION RISK: Your retirement income buys less every year

LONGEVITY RISK: You outlive your retirement income

Our goal is to make you feel more confident about your financial future.

Now let’s look at the different segments, or buckets, and how they work.

-

The goal of this first segment is to produce income for your near-term living expenses through the use of investments with little or no stock market risk, such as money market funds, certificates of deposit, immediate annuities, or other relatively conservative investments.

It’s designed to give you the money you need for the first year or two of retirement, available whenever you need it, for planned expenses and unplanned emergencies.

-

This bucket is set up to provide income for the next five to 10 years. It’s invested to provide more growth than the Now bucket while maintaining little to no exposure to stock market risk.

-

For the later phase of your retirement, this bucket has a long-term growth objective designed to offset the effects of inflation, support your charitable interests and provide a legacy for your spouse and children when the time comes.

Moving money between buckets

As time goes by, we’ll rebalance your buckets to replenish your Now and Soon buckets so you always have conservative funds available for your living expenses. Since it's not always a good time in the market to sell something, we carefully choose when we move money from one bucket to another.

Having several years of living expenses in the Now and Soon buckets helps us be more strategic about when to rebalance

All investments are subject to risk, including loss. The process of rebalancing may result in tax consequences. Annuities are subject to the claims paying ability of the issuing insurance company. Certificates of Deposit offer FDIC insurance and a fixed rate of return whereas both principal and yield of investment securities will fluctuate with changes in market conditions. Although money markets strive to maintain a stable net asset value, the funds are not federally insured and there is no guarantee that a stable net asset value will be maintained.

We’re here for you for life

We want you to be confident that you’re on the right path. You shouldn’t have to worry if you’ve done enough or whether something is falling through the cracks.

It’s a good feeling knowing that we’re always looking out for you.